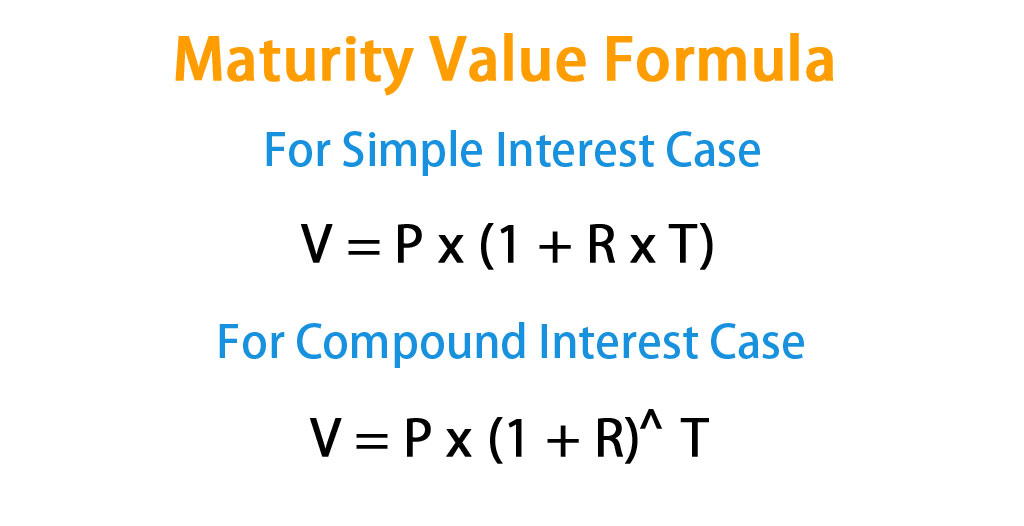

Maturity value formula

Present Value of a perpetuity is used to determine the present value of a stream of equal payments that do not end. P the bond price C the coupon payment i the yield to maturity rate M the face value and n the total number of coupon payments.

Yield To Maturity Approximate Formula With Calculator

Formula to Calculate Bond Price.

. The future value formula could be reversed to determine how much something in the future is worth today. If you plug the 1125 percent YTM into the formula to solve for P the. The formula for determining approximate YTM would look like below.

Yield to Maturity YTM Formula. Use the formula to arrive at the present value of the principal at maturity. Assume that there is a bond on the market priced at 850 and that the bond comes with a face value of 1000 a fairly common face value for bonds.

As you can see we have assumed that the current market value of Bond X is lower than the Face Value which indicates that it is trading at a discount. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The discount rate which makes the present value PV of all the bonds future cash flows equal to its current market price.

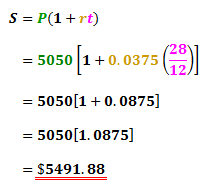

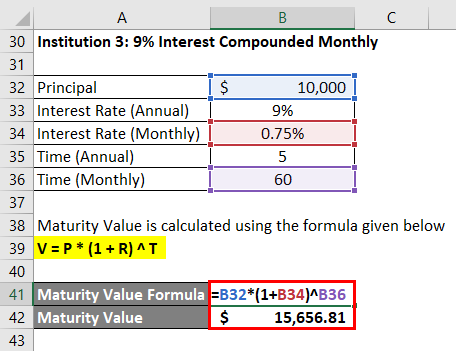

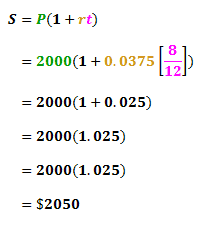

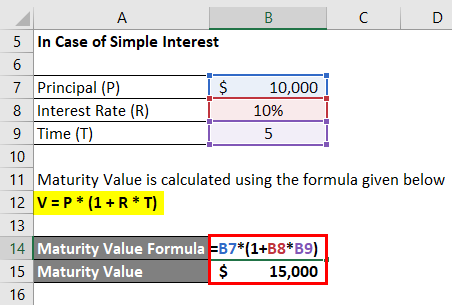

Which would spike the denominator in the yield to maturity formula thereby reducing. The variable r represents that periodic interest rate. The maturity value formula is V P x 1 rn.

Macaulay duration named for Frederick Macaulay who introduced the concept is the weighted average maturity of cash flows in which the time of receipt of each payment is weighted by the present value of that paymentThe denominator is the sum of the weights which is precisely the price of the bond. Present market price 1 r 5 future value. The realized yield to maturity will be the value of the rate of interest calculated through the following equations.

Further if the number of compounding per year n is known then the formula for present value can be expressed as. The denominator of the YTM formula will be the average price and face value. Plug the yield to maturity back into the formula to solve for P the price.

Yield To Maturity Face Value Current Bond Price 1 Years to Maturity 1 beginalignedtext. The YTM of 74 calculated here is for a single bond. The yield-to-maturity YTM is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity.

The present value of a perpetuity formula can also be used to determine the interest rate charged and the size of the regular payment. YTM 60 1000-90010 10009002 74. On this bond yearly coupons are 150.

V is the maturity value P is the original principal amount and n is the number of compounding intervals from the time of issue to maturity date. This lets us find the most appropriate writer for any type of assignment. Total future value 1574 1405 1254 1120 100 1000 16353.

You see that V P r and n are variables in the formula. These factors are used to calculate the price of the bond in the primary market. Yield to maturity YTM is the total return anticipated on a bond if the bond is held until it matures.

The formula uses some of the same values you used in the annuity formula. Net Present Value formula is often used as a mechanism in estimating the enterprise value of a company. In other words assuming the same investment assumptions 1050 has the present value of.

Future Value of Bond. One 1 311 lb. You see that V P r and n are variables in the formula.

Bag - Purina ONE High Protein Senior Dry Dog Food Plus Vibrant Maturity Adult 7 Formula. Bond pricing formula depends on factors such as a coupon yield to maturity par value and tenor. A perpetuity is defined as security eg bond with no fixed maturity date and the formula for calculating the present value PV of a perpetuity is equal to the cash flow value divided by the discount rate ie expected rate of return based on the risks associated with receiving the cash flows.

Plug in k and n into the present value PV formula. The future value of the bond is calculated in the following way. The formula for calculating the yield to maturity YTM is as follows.

About this item. The maturity value formula is V P x 1 rn. Read more is basically.

Finally the formula for present value can be derived by discounting the future cash step 1 flow by using a discount rate step 2 and a number of years step 3 as shown below. 600 1 r 5 163530. The Yield to Maturity of this bond calculated using the YTM formula mentioned earlier is.

Zero-Coupon Bond Yield-to-Maturity YTM Formula. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows which include coupon payments and the par value which is the redemption amount at maturity.

Use the annuity formula first then apply those same variables to the principal payment formula. The formula that is used for calculation of Maturity value involves the use of principal amount that is the amount which is invested at the initial period and n is the number of periods for which the investor is investing in and r is the rate of interest that is earned on that investment. Apply a formula to quickly calculate maturity value.

Happens and there is no more payment which a borrower has to pay afterward. For this example PV 100010025. In the context of zero-coupon bonds the YTM is the discount rate r that sets the present value PV of the bonds cash flows equal to the current market price.

Maturity as its name suggests is the date on which the final payment for the financial instrument like a bond etc. The coupon rate for the bond is 15 and the bond will reach maturity in 7 years. The yield to maturity YTM refers to the rate of interest used to discount future cash flows.

Chances are you will not arrive at the same value. The projected sales revenues and other line items for a company can be used to estimate the Free Cash Flows of a company and utilizing the Weighted Average Cost of Capital WACC to discount those Free Cash Flows to arrive at a value for the. The numerator of the YTM formula will be the sum of the amount calculated in steps two and step 3.

Said differently the yield to maturity YTM on a bond is its internal rate of return IRR ie. Rather than compute compounding interest manually you can use a formula. Purina senior dog food with MCT-rich vegetable oil to nourish and promote mental sharpness and showed an increased average activity level over 20 percent in dogs seven and older.

Use the perpetuity calculator below to solve the formula. Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the assets price. When one divides step 4 by step 5 value it shall be the approximate yield on maturity.

PV CF 1 r t. V is the maturity value P is the original principal amount and n is the number of compounding intervals from. Examples of Maturity Value Formula With Excel Template Maturity Value Formula Calculator.

In the secondary market other factors come into play such as creditworthiness of issuing firm liquidity and time for next coupon payments. Consider some set of fixed cash flows.

Ppt Yield To Maturity Formula Powerpoint Presentation Free Download Id 2938012

Finding Maturity Value Youtube

Zero Coupon Bond Formula And Calculator

9 1 Markup On Cost Selling Price Price For Product Offered To Public Ppt Video Online Download

Calculation Of Maturity Value On Recurring Deposit Class 10 Maths Icse Youtube

Calculate Maturity Value For A Simple Interest Account

Yield To Maturity Ytm Formula And Calculator

Calculting The Simple Interest And The Maturity Value Banker S Youtube

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Maturity Value Formula Calculator Excel Template

Calculate Maturity Value For A Simple Interest Account

Dheeraj En Twitter Maturity Value Formula Definition Step By Step Examples Amp Calculation Https T Co Vhq2kufnlt Maturityvalue Https T Co Viuk8ghkb3 Twitter

Zero Coupon Bond Value Formula With Calculator

Maturity Value Formula Calculator Excel Template

Calculation Of Maturity Value On Recurring Deposit Class 10 Maths Icse Youtube

Finding Maturity Value And Compound Interest Compounded Annually Number Sense 101 Youtube

Maturity Value Formula Calculator Excel Template